What do you call something that shows the expectation of inflation influences and in both interest rates and purchasing power? It’s the Fisher Effect. In 1930 a mathematic economist named Irving Fisher developed this Fisher effect formula as a part of overall economic theory, this formula is used in economics and finance calculations. The fisher effect formula is very beneficial for an investor plus it is used in academia and business also. The fisher effect formula calculates on three factors or values

- The nominal rate of interest

- The real rate of interest

- The inflation rate currently expected

What are the components of this formula?

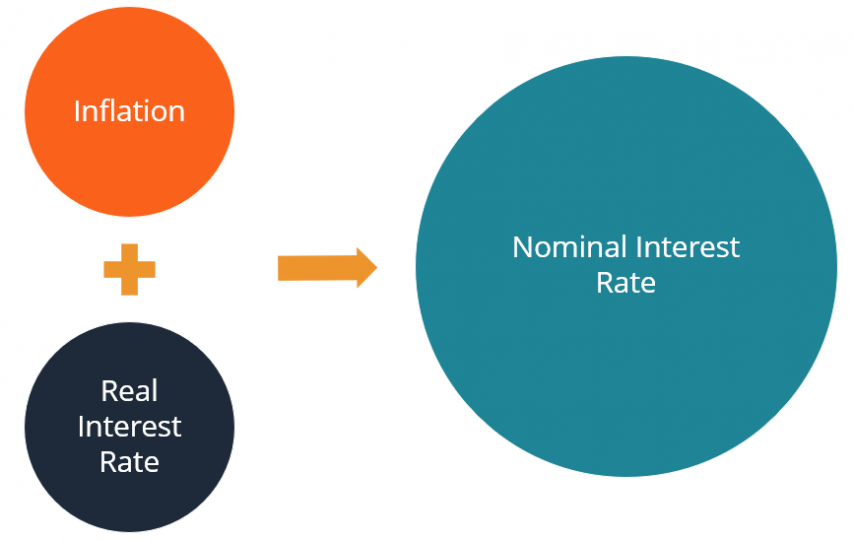

The fisher effect formula is an assumption calculation of one year, the 3 components required are the nominal interest rate, the real interest rate, and the expected rate.

What is the nominal rate of interest?

The nominal rate of interest is the percentage that shows the price u paid for the use of money without inflation.

What is the real rate of interest?

It is the percentage that is adjustable and it removes the inflation effect and gives a real purchase power.

What is the expected rate of inflation?

It is the percentage of those changes as per the economic cycles.

How is the formula calculated?

Once you understand the formula, the calculation of the fisher effect is very easy. The formula is RNOM ( Nominal interest rate) = RREAL ( Real Interest Rate) + E (Expected rate of inflation). To make it easier to calculate the formula you should divide the equation into two steps. First NROM ( Nominal interest rate) – E (Expected rate of inflation) = RREAL ( Real Interest Rate), after this calculate the real purchase power, for example, take $1000 and multiply it by RREAL and then whatever the result may be subtract it by 1000, now if you get RREAL of about 2% then the purchasing power of $1000 will be $98.

Why is the fisher effect an important tool?

This is important because it lets a lender calculate whether he is earning profit or not by the loan he has granted. The profit from interest is only possible if the rate that is changed is beyond the economic inflation rate. Not only this as per the fisher’s theory even if as a lender you grant a loan with no interest, but you will also need to charge the inflation rate, just in order to retain the purchasing power when the repayment is done.